50+ why did i get a 1099-int from my mortgage company

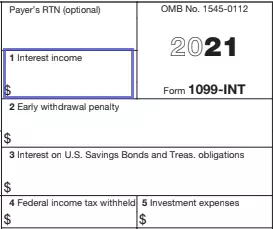

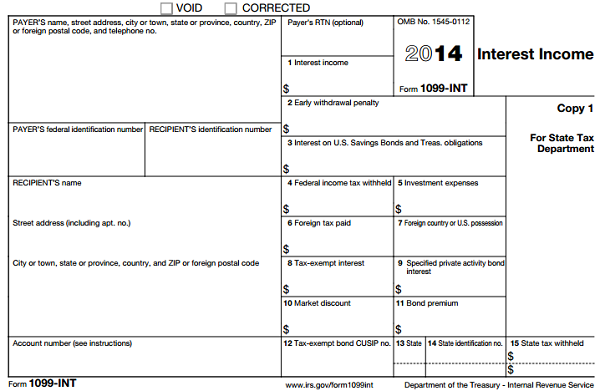

Web If an individual bank or other entity pays you at least 10 of interest during a calendar year that entity is required to issue a 1099-INT to you. 31 each year and.

Tax Strategies Blog Greenbush Financial Group

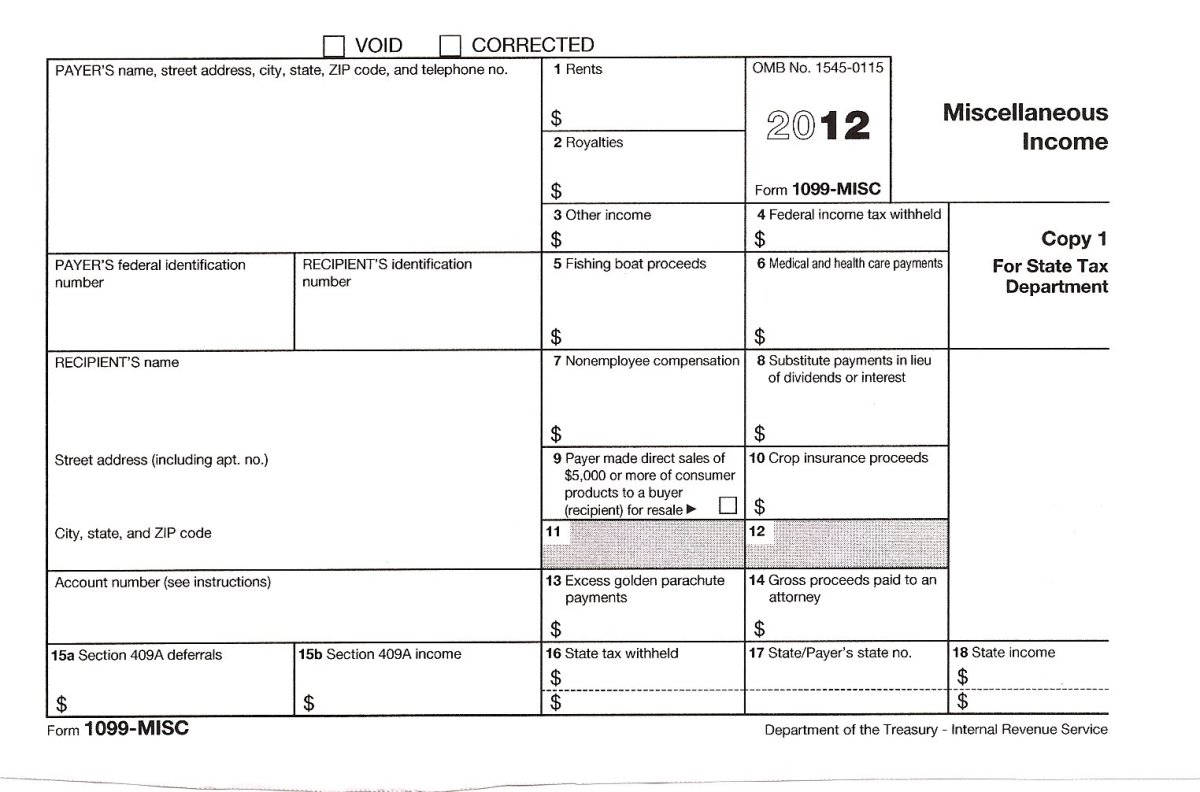

Form 1099-MISC documents miscellaneous income.

. Do I put that in the 1099-int section TurboTax Premier Online 0 1 2766 Reply 1 Best. If your deposit accounts have the same primary Taxpayer Identification Number TIN and 5-digit ZIP code from. Web Why does my Form 1099 include interest from multiple accounts.

If in one year you contribute more than what is allowed the difference. This document is sent if you had an escrow account that earned 1000 or more in interest throughout the tax year. Companies are required by law to send W-2 forms to employees by Jan.

Web You should receive a 1099-R if you collected at least 10 in distributions over the course of the tax year. Web Up to 96 cash back Regarding missing form 1099-INT if you have interest income of at least 10 youll usually receive a Form 1099-INT. And if you had income tax taken out of those payments.

Ad A Tax Agent Will Answer in Minutes. Its from a mortgage company the money went back into escrow account. Questions Answered Every 9 Seconds.

However if you dont receive the form you must. Web The IRS will send a Form 1099-INT in January 2021 to anyone who gets a payment of at least 10. March 9 Reuters - SVB Financial Group SIVBO scrambled on Thursday to reassure its venture capital clients their money was safe after a.

I was under the impression that they. Types of income include prize. Used to alert the IRS that an event took place foreclosure deed in lieu of foreclosure etc 1099-C.

It also has to give you a. Web It is either 6000 7000 if you are 50 or older or 100 percent of your earned income whichever is less. Its only for a dollar and change but it has me curious.

If you received a payout of over 600 in a given year from a business you should have received a 1099-MISC. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. This interest payment is due to the IRS postponing this years.

Web The 1099 Interest form is typically referred to as the 1099-INT. Web I got 1099-INT from my mortgage company and Im wondering why. Web Stock tumbles 60 drives other banks sharply lower.

Needed when a debt is cancelled forgiven or discharged.

1099 Problems Self Employment And The Future Of Financial Services

15 Prasenzauktion Erlesener Weine Munich Wine Company

Travsim H2o Usa Sim Karte Fur 60 Tage 5gb Mobile Daten Vereinigte Staaten H2o Us Sim Karte Amazon De Elektronik Foto

Entering Basic Taxpayer Information Into Taxwise Pub Ppt Download

What Is A 1099 And Why Did I Get One Toughnickel

Irs Form 1099 Int Fill Out Printable Pdf Forms Online

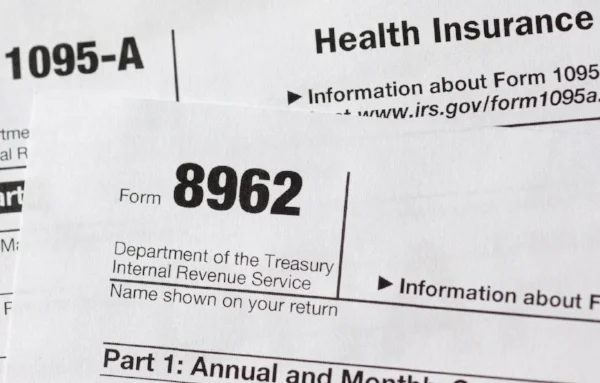

Tax Preparation Blog Healthcare Counts

Freedom Mortgage Tcpa Class Action Lawsuit 37

Understanding Tax Form 1099 Int Novel Investor

1099 Problems Self Employment And The Future Of Financial Services

:max_bytes(150000):strip_icc()/FORM1099-INTcopy-a8b728a7d75b4b8894837312523f37b6.jpg)

Form 1099 Int What It Is Who Files It And Who Receives It

What Is Form 1099 Int How It Works And What To Do Nerdwallet

:max_bytes(150000):strip_icc()/tax_returns_-5bfc3256c9e77c00519be8b1.jpg)

Form 1099 Int What It Is Who Files It And Who Receives It

1099 Int Your Guide To A Common Tax Form The Motley Fool

Tax Forms Quill Com

Top Tax Write Offs And Deductions For Freelance And Work From Home Employees Hubpages

Backdoor Roth Ira 2023 A Step By Step Guide With Vanguard Physician On Fire